Do a good job in the "connector" of medical informatization, and Tencent won two awards in the smart medical insurance competition of the National Medical Insurance Bureau

"These insured persons have abnormal behaviors and data." Recently, the law enforcement department received a report on medical insurance fraud. The difference between this report and the previous public reports is that this report is to find the "worm" hidden in the vast crowd with the help of big data, artificial intelligence algorithms and other scientific and technological means. After investigation, a 24 person insurance fraud gang emerged, and 56 other suspects were arrested.

The insurance fraud group with 80 people can be discovered at one time. Thanks to the integration and application of digital technology in Tencent's "precision medical insurance fund supervision solution based on medical insurance big data", recently, the "smart medical insurance solution competition" hosted by the National Medical Security Bureau held an award ceremony, which stood out from 156 competition plans submitted by 133 enterprises from 25 provinces and cities across the country. After fierce competition in the preliminary, second round and final, It won the first place in the final and the second place in the public service sub track in another Tencent project, "Smart Medical Insurance Public Service Solution".

The event aims to pool the wisdom of the whole society, solve the bottleneck problems that restrict the high-quality development of medical insurance, encourage the participating teams to explore and find high-value problems, and propose verifiable and effective solutions, which will greatly boost the medical insurance industry. In the future, the above scheme will be implemented in various places based on the unified base platform - medical insurance WeChat. Ni Jianwen, vice president of Tencent Health, said that Tencent had built a "smart medical insurance connector" - WeChat for medical insurance based on "connectivity" capability and big data technology, which opened up various scenarios of business applications, and focused on building an elevator extending in all directions for the "smart medical insurance building", so that information could shuttle orderly in the building and people could enjoy services conveniently in the building.

From medical insurance security to medical insurance public service, Tencent Health responded to the policy guidance of digitalization and intelligentization of medical insurance in China's "Fourteenth Five Year Plan" national medical security plan, gave play to its technical advantages and connectivity capabilities, promoted the closed-loop of intelligent medical insurance service with digital technology, and contributed to building a unified, efficient, compatible, convenient and safe medical security information system covering the whole country.

Building smart medical insurance requires digital technology to "connect" and "activate"

Why is smart medical insurance so important? From a macro perspective, medical security is a ballast to improve people's wellbeing and maintain social harmony and stability. According to the Statistical Bulletin on the Development of National Medical Security in 2021, by the end of 2021, the number of people participating in the national basic medical insurance was 1.36 billion, with the participation rate stable at more than 95%, and a medical security network covering the largest population in the world was built.

In September 2021, the General Office of the State Council issued the National "Fourteenth Five Year Plan" for Medical Security for All, pointing out that the informatization level of medical security should be significantly improved, the Internet plus medical and health insurance services should be constantly improved, and the big data and intelligent monitoring of medical insurance should be fully applied. Under the framework of continuous evolution of digital technology and accelerating the construction of digital China, building smart medical insurance has become an important means to improve people's livelihood and ensure people's life and health. It is also an inevitable requirement for deepening medical reform and leading the high-quality development of medical insurance.

However, the huge number of insured people and a large number of participants have brought amazing and complex medical insurance data, resulting in fragmentation of information systems, disunity of standards, large differences in business functions, and fragmentation of services. This means that the construction of smart medical insurance needs to get through multiple links, so that digital technology can give full play to its ability to connect and activate, and achieve a "chess game" pattern of nationwide medical insurance informatization from top to bottom.

In the field of medical insurance, digital technology makes people feel more "acquired"

Among them, the supervision of medical insurance fund and the public service of medical insurance are two important directions for the transformation and implementation of digital technology in the field of medical insurance, as well as two key points for realizing the closed-loop of intelligent medical insurance services.

The supervision of medical insurance fund is the top priority for the healthy development of medical insurance. However, the traditional way of supervision relies on human resources, with high cost, low efficiency and insufficient supervision power. It is passive in the face of groups with many roles, members and hidden criminal tactics. The "Fourteenth Five Year Plan" clearly proposes to establish an intelligent monitoring system in an all-round way to promote the transformation of medical insurance fund supervision to big data intelligent monitoring in all directions, processes and links.

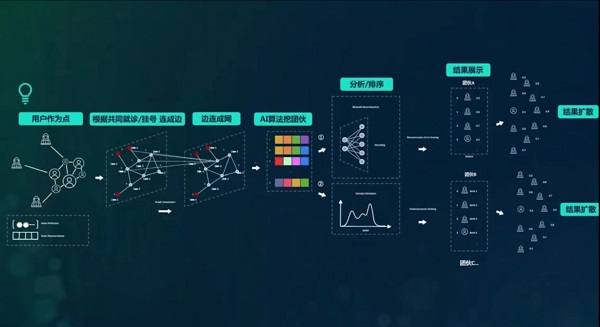

Tencent won the first prize of the total score of the "Smart Medical Insurance Solution Competition", "Precision Medical Insurance Fund Supervision Solution Based on Medical Insurance Big Data". Relying on the leading AI technology of Tencent Tianyan Laboratory, combined with medical insurance big data and medical insurance knowledge map, unreasonable drug use, terminology standardization engine, medical federal learning and other innovative AI technologies, Tencent first proposed an algorithm model for the detection of gang fraud against medical insurance funds in the industry, And online payment interception in advance.

This scheme can actively find the abnormal points of the insured population, excavate the clues of the criminal gangs, and intelligently analyze the data, so as to find more key groups with abnormal medical insurance behaviors, providing reference for the regulatory decisions of the relevant departments. The program also adapts to the data standard of the national unified information platform, which facilitates flexible access, deployment and promotion of all levels of departments nationwide.

At the same time, Tencent has built a bridge between supervision and service through medical insurance WeChat, allowing regulators such as the medical insurance bureau to more quickly manage and view insured data, collect evidence, including video information, LBS geographic location, etc., and conveniently build a communication working group based on a group of abnormal data, so as to achieve the synchronization of task reminder, communication, evidence collection, investigation, feedback, and processing, and improve the regulatory efficiency. In the future, the scheme can also be integrated into more regulatory scenarios such as outpatient, pharmacy, online and offline payment through medical insurance WeChat, and the regulatory window can be put in front to achieve the regulatory goal of rapid early warning, real-time communication, and timely loss stop.

On the other hand, as the base platform, medical insurance WeChat also plays a core role in the field of medical insurance public services. If you want to provide the insured with a comprehensive and experienced online medical insurance service, you need to build a "highway" from the medical insurance department to the ordinary patient, connecting the medical insurance bureau, designated institutions, grass-roots agencies and other institutions and departments at all levels, thus helping medical insurance service providers upgrade their service capabilities.

Tencent won the "Smart Medical Insurance Public Service Solution" with the second overall score of the public service sub track of the "Smart Medical Insurance Solution Contest". Based on the user ecosystem of WeChat, enterprise WeChat and government WeChat, Tencent connected the medical insurance bureau, two designated institutions, insured units and insured people through the medical insurance WeChat, laying the foundation for the medical insurance information construction and intelligent services, which can make the insured more active More intelligent medical insurance services.

On the one hand, medical insurance WeChat provides a channel for information and business collaboration between medical insurance bureaus and institutions, realizing "one picture for the city's medical insurance" and "one picture for the city's medical insurance", and timely issuing policies and notices, conducting meetings, transparent management, etc. to departments and subordinate units; On the other hand, the online medical insurance service matrix brought by medical insurance WeChat can provide the insured with online medical insurance payment settlement, payment records of the insured, consumption details query, insurance registration, off-site medical record, medical insurance payment and other medical insurance businesses, and constantly expand the smart and convenient application scenarios of medical insurance business.

Support the construction of "smart medical insurance building" and promote the closed loop of smart medical insurance services

It can be seen from the original intention and awards of the Smart Medical Insurance Solution Competition that, under the guidance of the policy of building a "chess game" pattern of national medical insurance informatization, it is essential to integrate and open up internal and external data, and build a convenient and intelligent connection mode, which is the basis for realizing the intelligent management of medical insurance services.

Tencent Health relies on its ability to build technology, resources and ecological connectivity to actively promote the construction of smart medical insurance. Based on the WeChat system, it innovatively launched a smart medical insurance reform service platform - the medical insurance WeChat platform. It connects medical service institutions such as medical insurance bureaus, hospital pharmacies, and urban insured personnel, carries out unified and collaborative data management, and promotes the closed loop of smart medical insurance services.

On the one hand, Tencent Health is committed to solving medical insurance security, medical insurance management and other issues based on its own cloud computing, big data, artificial intelligence and other advantageous technologies to meet the demand for innovative development of government governance services of city level medical insurance bureaus; On the other hand, Tencent Health, relying on electronic medical insurance vouchers, continues to reach the insured, providing efficient public medical insurance services and more convenient medical and drug services.

In the future, Tencent Health will continue to face the forefront of scientific and technological innovation and application, meet the needs of medical insurance reform and development, face the people's life and health well-being, open technology and connectivity to industry partners, "lay the foundation and repair the elevator" to improve the modernization of medical insurance governance, help the complete construction of "smart medical insurance building", and work with provinces and cities to accelerate the modernization of medical insurance governance system and governance capacity, Let medical insurance services be "convenient and accessible, intelligent and accurate, online available, safe and reliable", and effectively improve the experience and satisfaction of insured people.

Related News